kansas sales and use tax exemption form

92-20-18 exempt the sale of rolling stock including buses and trailers repair or. Wholesalers and buyers from other states not registered in Kansas should use.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Streamlined Sales and Use Tax AgreementCertificate of Exemption Kansas This is a multi-state form.

. Sales Tax Account Number Format. Individual Kansas consumers buying goods in other states or through catalogs mail-order companies over the Internet or from television magazine or newspaper advertisements must. Not all states allow all exemptions listed on this form.

And all sales of repair. You can download a PDF of. Kansas Department of Revenue HOME ABOUT.

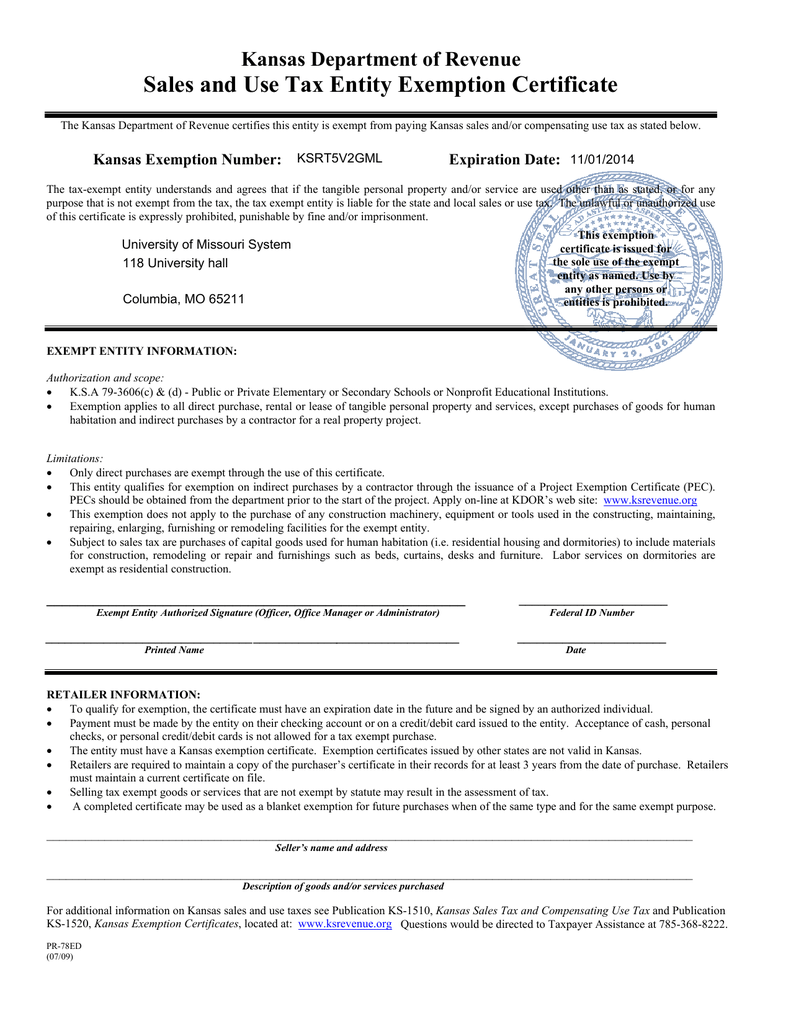

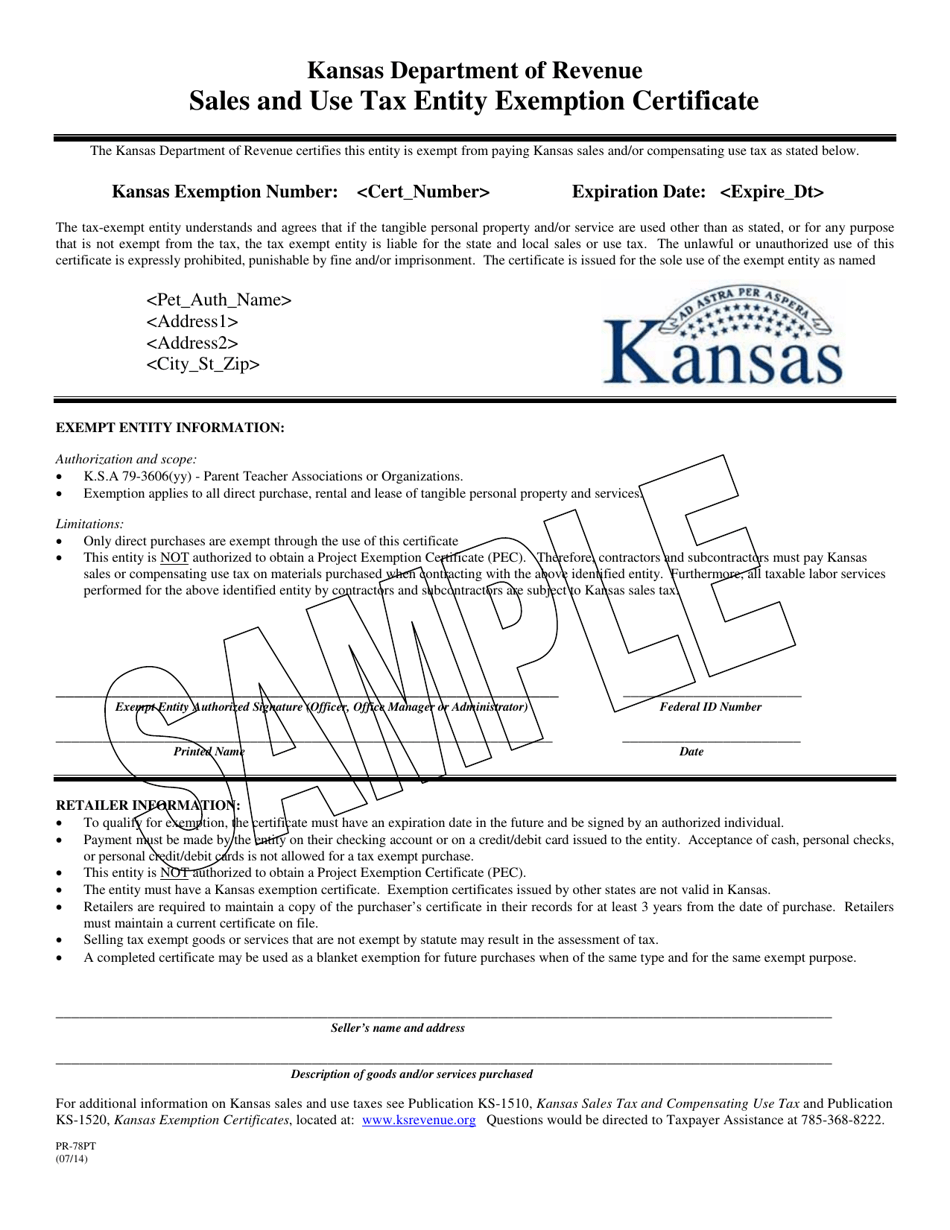

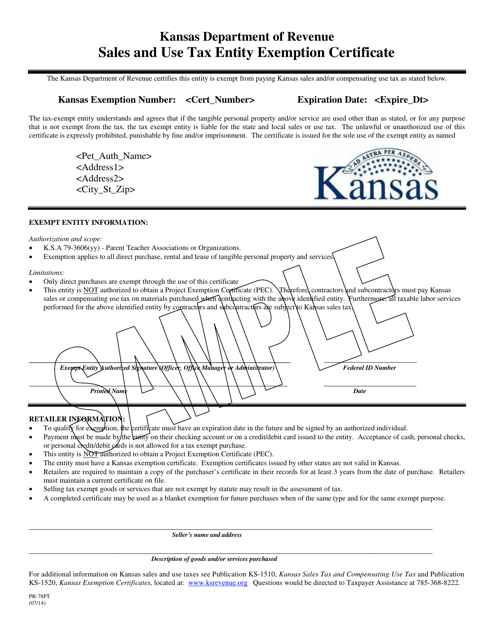

Kansas Department of Revenue. The format of this sample can be used to create legally valid exemption certificates to be filed with a seller at the time of a purchase. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible personal property in a warehouse or distribution facility in Kansas all sales of installation repair and maintenance services performed on such machinery and equipment. Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property such as a PTA or a nonprofit youth development organization should use the exemption certificate issued to it by the Kansas Department of Revenue when buying items for resale. Ks Sales Tax Exemption Certificate information registration support.

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor. Sales and Use Tax Entity Exemption Certificate. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

It is designed for informational. Purchasers are responsible for. All construction materials and prescription drugs including prosthetics and.

To apply for update and print a sales and use tax exemption certificate. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree.

Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. KS-1525 Sales Use Tax for Contractors Subcontractors and Repairmen. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax.

Your Kansas sales tax account number has three distinct parts. Order for the sale to be exempt. Tax Policy and Statistical Reports.

How to use sales tax exemption certificates in Kansas. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from.

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates. Ad New State Sales Tax Registration.

Kansas Sales And Use Tax Entity Exemption Certificate. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Form Kansas Exemption Certificate - Tax Exemptions Forms.

Kansas Department of Revenue - Pub. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt.

You can download a PDF of. If you are accessing our site for the first time. Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts.

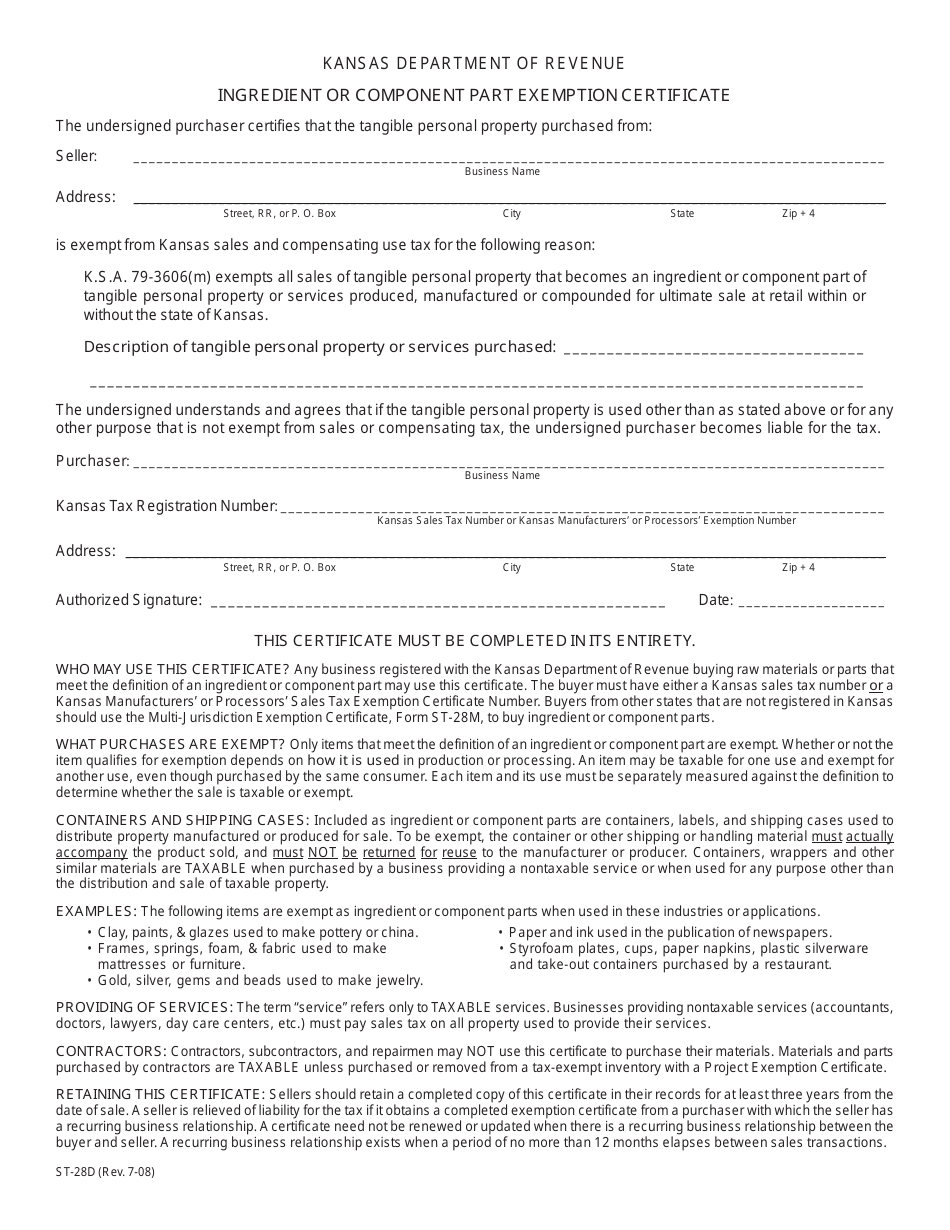

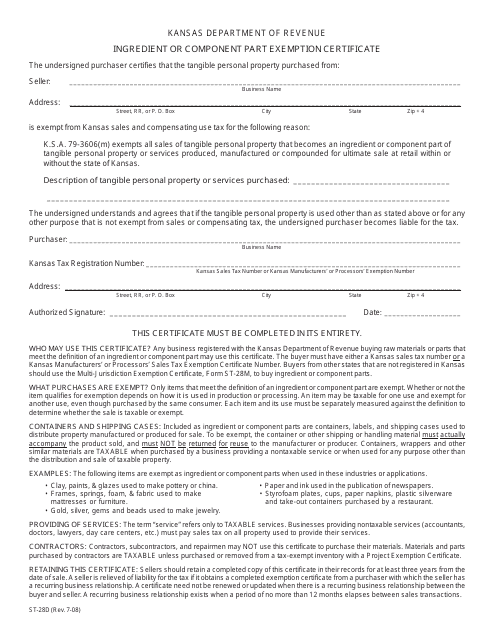

Is exempt from Kansas sales and compensating use tax for the following reason. The Kansas Department of Revenue provides a complete package with all forms related to certifying that a. Enter your Sales or Use Tax Registration number and the.

Burghart is a graduate of the University of Kansas.

Saas Sales Tax For The Us A Complete Breakdown

Review The Requirements And Process For Obtaining An Employer Identification Number For Tax Employer Identification Number Employment Internal Revenue Service

Council Tax Free Months 2022 Why Don T You Pay Council Tax In February Marca

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Sales Tax Guide For Online Courses

Sale Vintage Wwii Gas Tax Exemption Booklet Kansas Home Front Etsy Gas Tax Booklet Wwii

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller